Specification Rate Declines for Biggest Manufacturers of Porcelain Tile

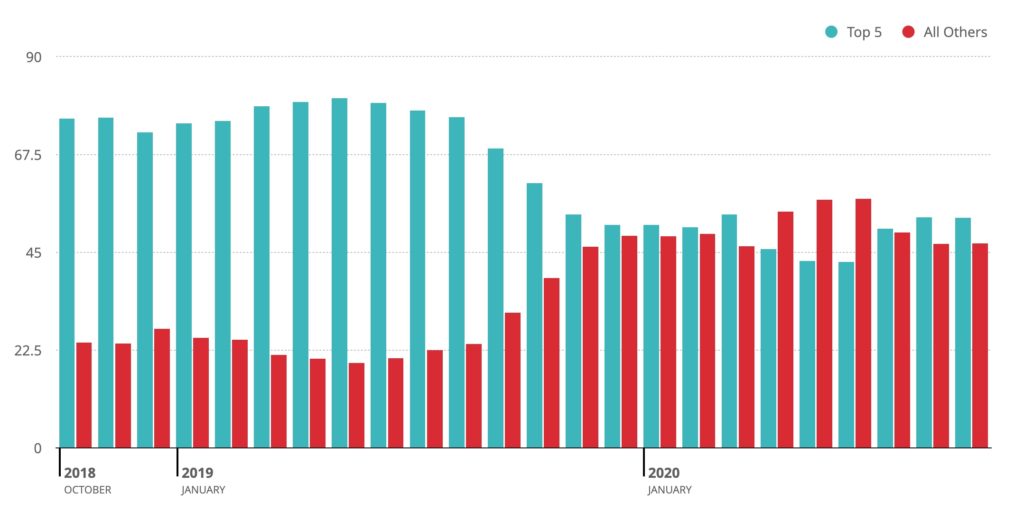

There’s news in the world of porcelain tile specifications that’s of interest to both large and small firms: during the past 12-15 months, the five largest manufacturers have endured steady erosion. As the graph below illustrates, this is no small change. The specification share as Basis of Design of the top five (Daltile, Crossville, Emser Tile, American Olean Tile, and Florida Tile) declined from 80% in June of 2019 to 41% in June of 2020.

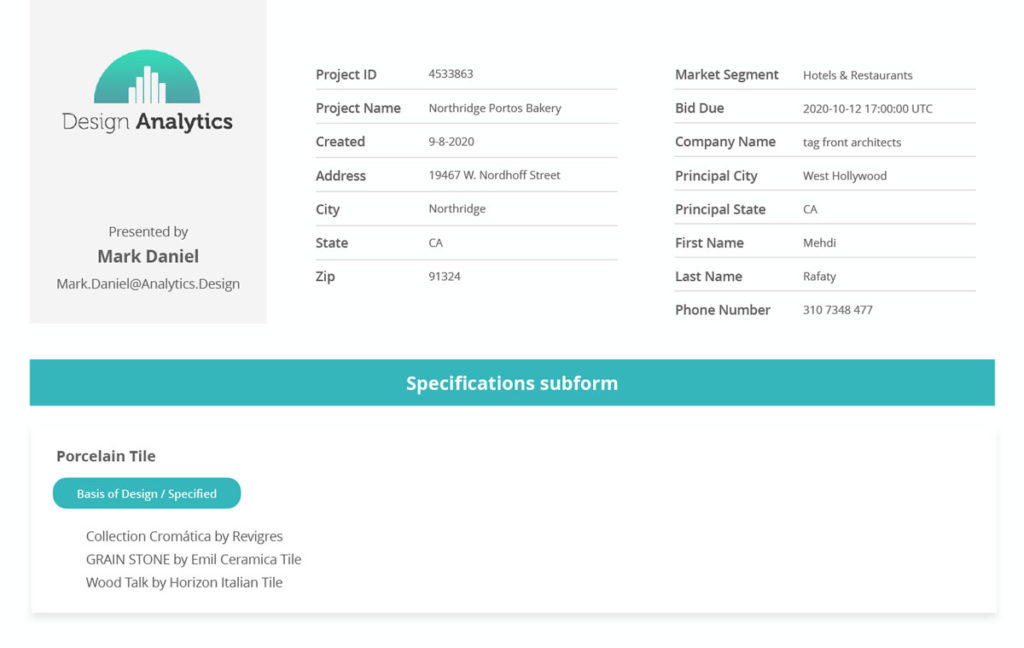

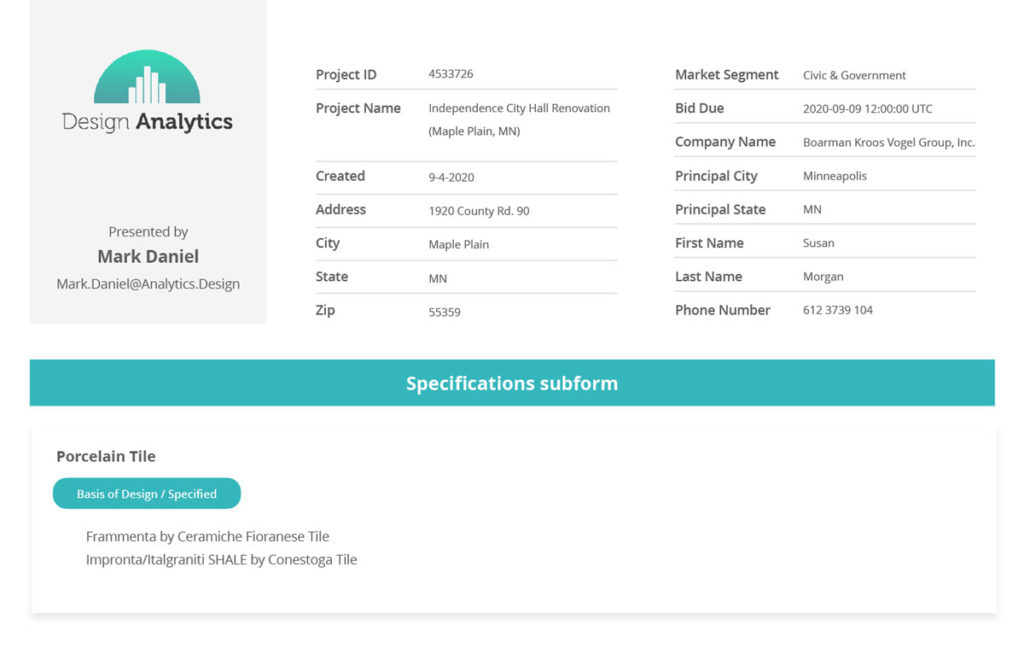

This trend has been identified by Design Analytics data compiled using specification documents focusing specifically on Basis of Design. Below are some examples of projects—released for bid in September—in which none of the majors are mentioned either in the specifications or in the finish schedule. Click on each project for a larger view.

Project 1: Northridge Portos Bakery, West Hollywood, CA

Project Two: Independence City Hall Renovation, Maple Plain, MN

Project Three: Algona Public Library, Des Moines, IA

Since it will likely be some time before these projects are built, the actual consumption of porcelain tile will not change immediately; however, the decline is large enough that some impact on sales is inevitable.

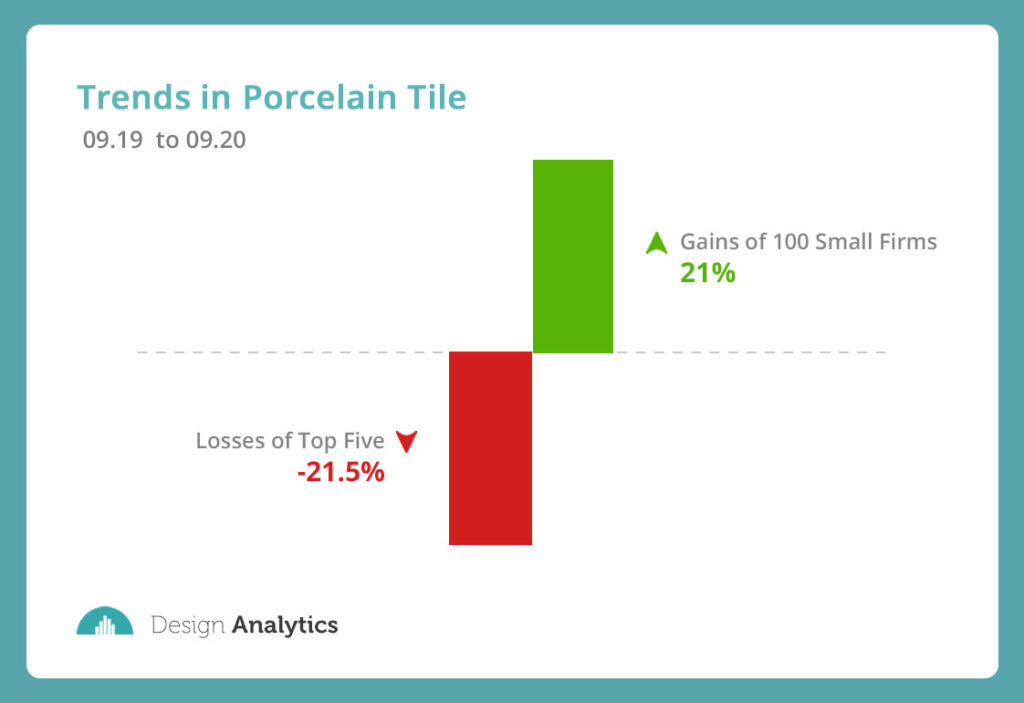

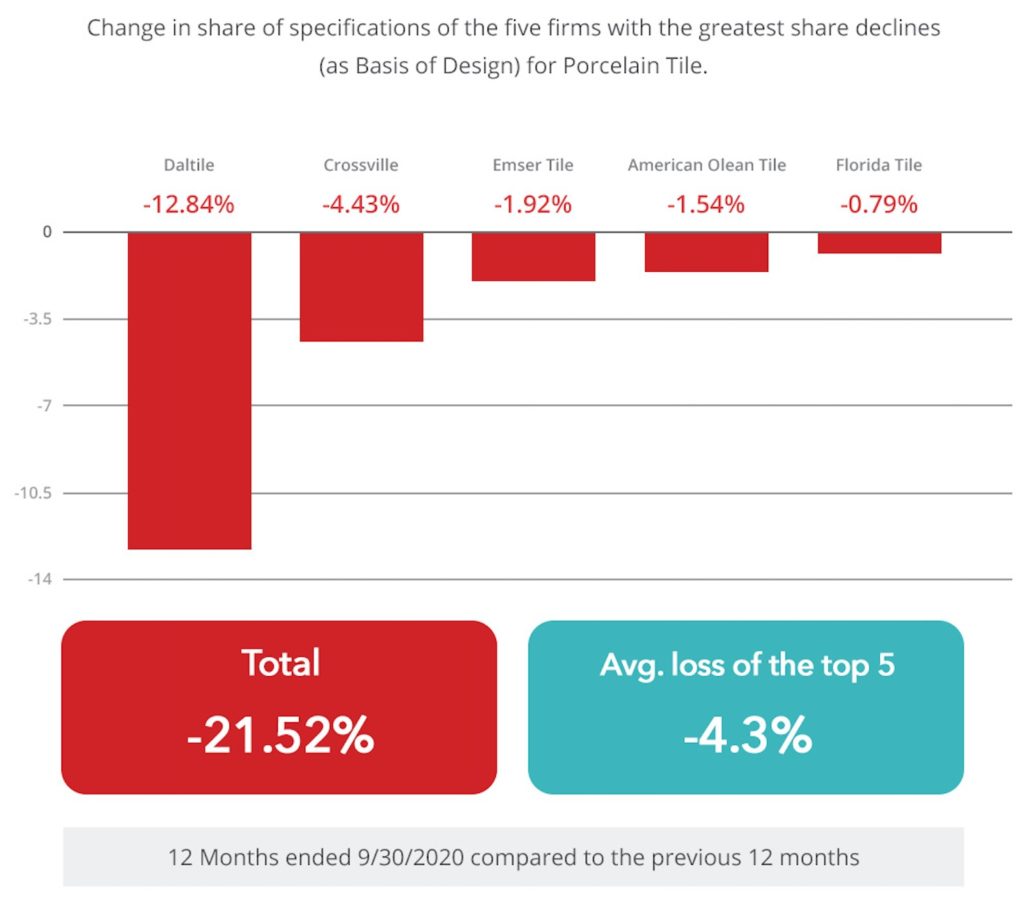

From June-September, the top five rebounded somewhat, closing with a 52% specification share as Basis of Design, yet the total decline remains significant, with a change of -21.52% for the one-year period ending 9/30/20. Daltile and its flagship products have been hit the hardest here. Their 12.84% decline represents 60% of the total drop, and their top-selling porcelain tile collections (Keystones, Volume 1.0, and Portfolio) represent over half of that, meaning that the decreases in specification share as Basis of Design for just three products account for nearly a third of the total decline. The graph below shows the market losses of each of the top five manufacturers of porcelain tile.

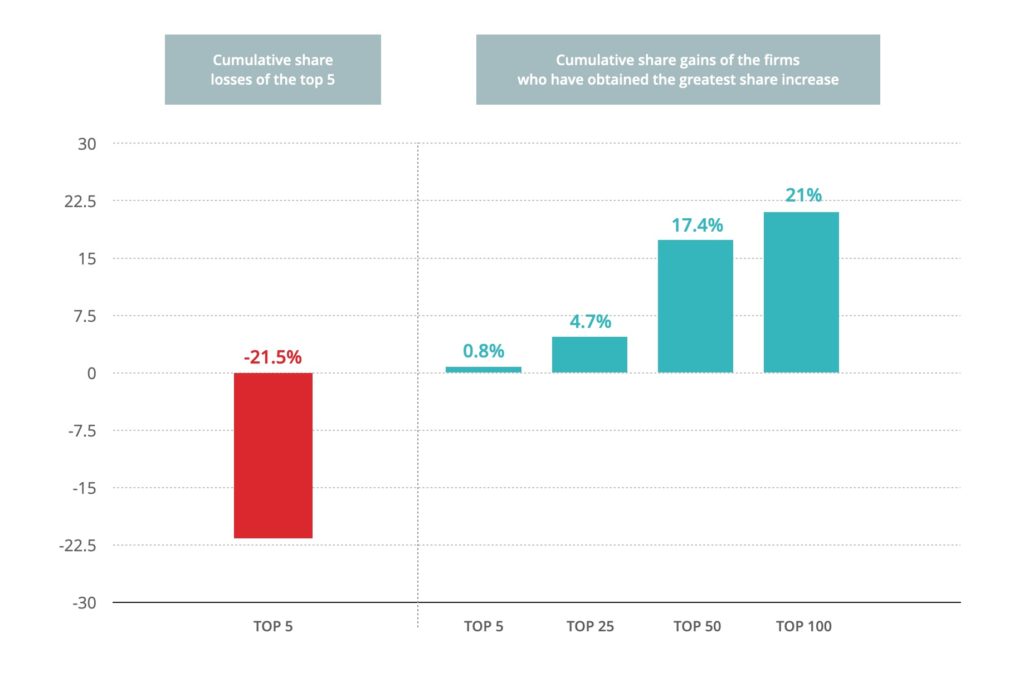

While this may be unwelcome news for the top five, it’s an auspicious development for smaller companies, as further data shows that these changes are not owed to a handful of specification increases among larger companies, but rather to incremental gains among “smaller” firms—a broad category which includes known brands like Artistic Tile as well as locally oriented companies with a less prominent national presence. While the average loss of the top five was 4.3%, the average gain of the five firms that grabbed most of that share was less than one percent. Here’s another metric to help put the distribution pattern of the new gains in perspective: the total growth in specification share as Basis of Design of the 100 firms that saw the greatest growth is actually less than the losses sustained by the top five firms.

So what’s causing the change? Why this ascendant pattern of smaller companies (perhaps with a more local presence)? While the Pandemic might appear to be the elephant in the room, in this case the timeframes don’t cohere, as the decline began in June of 2019 and COVID didn’t hit China until December. So the consensus in the industry is that it’s still anybody’s guess—though those in a position to make educated conjectures point to a handful of possibilities:

1. Convenience/Going Local: Could there be an implicit preference for local distribution? One could make the case that the current zeitgeist tips in this direction, i.e., it’s de rigueur to support smaller companies over corporate behemoths. Beyond feeling good about where you’re putting your dollar, local contact has other advantages, including more accessible inventory, shorter lead times, possibly better customer service, and interpersonal connection (working with someone you already know).

2. Price: Though it might seem paradoxical, many small firms rely on imports to provide competitively priced products. This thesis becomes more compelling when we note that the two companies with the largest share of specification as Basis of Design (Daltile and Crossville Tile) have a significant production presence in the U.S. and Mexico. Florida Tile (fifth largest) is also U.S.-centric, stating in PR materials that “we manufacture the vast majority of our product offering in the U.S.A.” So it may be that the market inroads of small companies willing to work for very thin margins in order to attract customers is also contributing to the decline of the top five.

3. Stylistic Diversity: We might liken this to a parallel phenomena seen in Ancillary Furniture, whereby specification share as Basis of Design has shifted from a handful of the major companies to a host of the minors. Turns out they may not be so “minor” after all, as prevailing tastes seem to demand more choice in style and pattern than the larger companies can provide. It’s possible we’re witnessing the same development in porcelain tile, notwithstanding the abundant inventory of Daltile and the other top manufacturers. Perhaps cost savings are operating simultaneously with stylistic diversity and local accessibility to steer customers away from the largest firms.

In addition to the above, industry insiders offer alternative explanations, remarking on rising installation costs as well as the larger-size styles of porcelain tile. These larger formats require more skilled labor—a resource that’s becoming less and less available.

Joshua Levinson, President Wholesale of Artistic Tile, concurs with the above while suggesting that the story is a bit more complicated: “My take is that the anti-dumping and countervailing duties levied on Chinese ceramic tile and porcelain have done their job… they have leveled the playing field, making high design European imports more viable.” In this theory, the increased demand for larger format tile drives enhancements in quality and design, thus making higher priced tile from Europe a compelling alternative. Says Levinson, “An investment in leading edge design and technology makes more sense today than it has in recent years.”

Whatever the cause, the change in specification share as Basis of Design is not necessarily “good” or “bad” news to anyone in the industry, but rather represents an opportunity for all to capitalize on more granular methods of data collection. Design Analytics will be keeping an eye on these trends—of porcelain tile and all fixtures, furniture, and equipment across the different segments. We also welcome any comments/theories about what may be happening in porcelain tile as well as observations relevant to this trend of local preference. Let’s keep the conversation going, and we’ll report back soon with another look at Analytics trends in Architecture and Design.

Leave a Reply