Absolute Growth Furniture Index: Restoration Hardware Joins Steelcase and Herman Miller

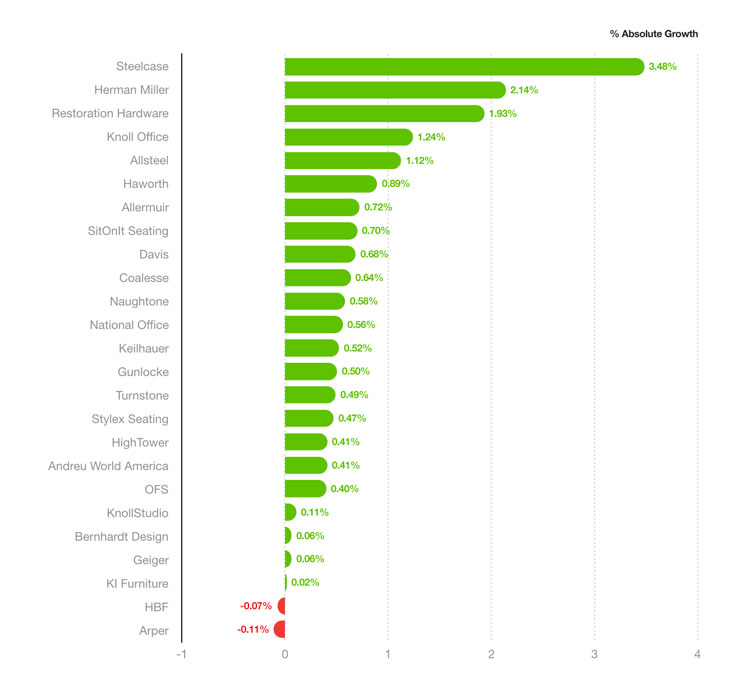

Data for annual growth among leading furniture brands for the period ending September 30, 2018 reveals some expected results, as well as, some surprises. Note that we’re using Absolute Growth for this analysis as opposed to Nominal Growth. Absolute Growth is the total increase in Spec Share year over year, whereas Nominal Growth is the percentage increase in Spec Share year over year.

Using Absolute Growth is the best measure of market activity because it’s a true indication of total increase in specification frequency. For example, while SitOnIt Seating experienced 273% Nominal Growth (the frequency of furniture specified increased by a factor of 2.73x) compared to 162% for Steelcase (frequency of furniture specified increased by a factor of 1.62x), Spec Share for SitOnIt increased from .21% to .91% (.70% Absolute Growth), while Spec Share for Steelcase increased from 2.15% to 5.63% (3.48% Absolute Growth), which is a significantly greater total frequency of furniture specified than that of SitOnIt.

The presence of Steelcase and Herman Miller is not surprising. However, Restoration Hardware (#3), SitOnIt Seating (#8), Naughtone Furniture (#11), and National Office Furniture (#12) are definitely not the “Usual Suspects.” The rise of Restoration Hardware—a well-known retailer and residential brand—is noteworthy because it demonstrates the prevalence of the “resimercial” trend. RH’s competitiveness with major brands Steelcase and Herman Miller may indicate the continued influence of a significant shift in spec patterns.

In regards to SitOnIt, Naughtone, and National Office, their appearance piques our curiosity as well. The significant Absolute Growth of SitOnIt and National Office—once generally thought of as dealer-centric brands—indicates a shift from high design towards furniture with a compelling balance of cost and quality. Naughtone is a bit of a wild card. Their Absolute Growth of .58% is formidable, and their nominal growth of 209% is even more impressive, especially for a British brand with an air of exclusivity and limited distribution.

However, Naughtone’s rise is almost certainly owed to the company’s recent partnership with Herman Miller in 2016. This trend of “lifestyle” brands partnering with industry heavies is beginning to be a palpable force in spec patterns. In this regard, we’ve got our eye on Steelcase. Their recent absorption (in September of this year) of Orangebox—a UK-based manufacturer of innovative workplace furniture—is in line with the lifestyle partnership trend. Steelcase already leads all brands in Absolute Growth, so we’ll be especially curious to see how this move impacts their performance moving forward.

The data for this snapshot is courtesy of Designer Pages’ sister-brand Design Analytics. For more information on research opportunities, contact analytics@designerpages.com.

Disclaimer: The above reports do not include specifications for subsidiaries (e.g. Steelcase doesn’t include Coalesse).

Leave a Reply