Analytics Trends: Rising Popularity of LVT

In recent years, Luxury Vinyl Tile has enjoyed increased growth while also realizing a certain cultural cache. With aesthetic improvements lending new realism, overlays of textiles and textures, enhanced imagery including options for hand-painted art, and customized color palettes, LVT has begun to rival the look of natural wood or stone while remaining a lower-cost option.

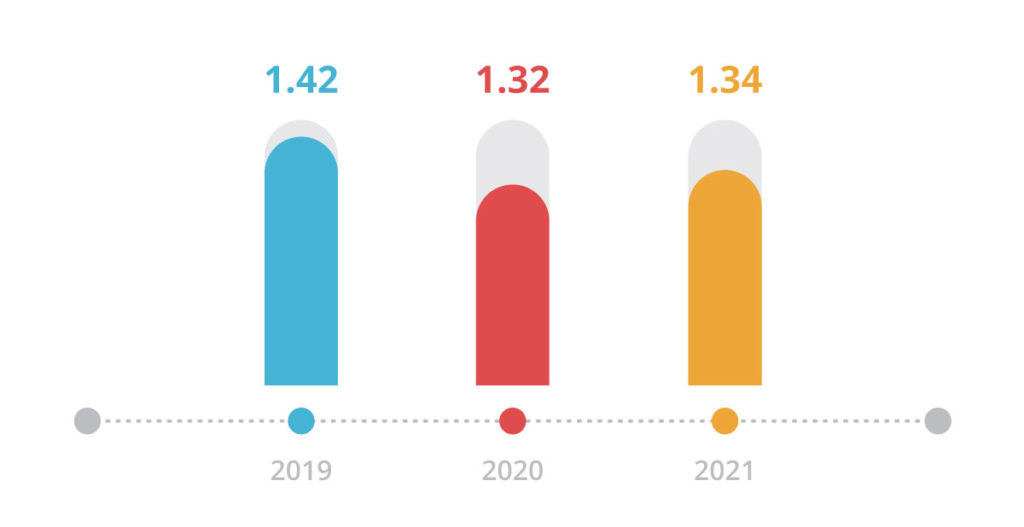

The ascendance of the category comes into high relief when we compare it to carpet. In 2019, the ratio of LVT to Carpet was 1.42, meaning that for every instance of projects with LVT, there were 1.42 projects with Carpet. In 2020, this number decreased to 1.32. 2021 saw stabilization of this trend, with a ratio of 1.34.

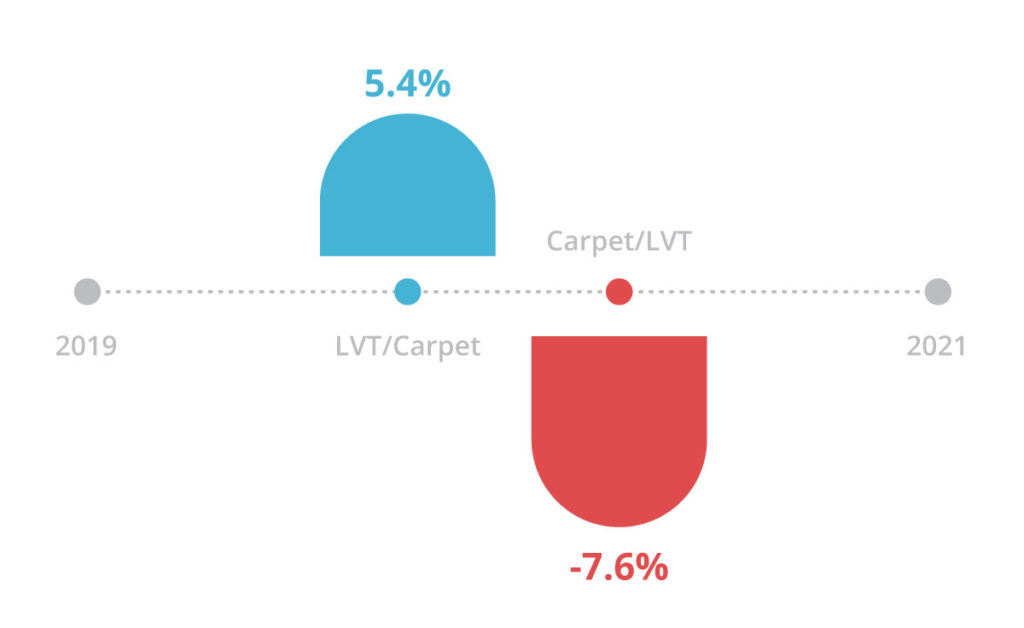

Another way to visualize this is year-over-year percentage. As shown in the graphic below, the ratio of LVT to Carpet increased by 5.4% from 2019 to 2020, while during the same period Carpet decreased by 7.6% relative to LVT. In 2021 (YTD), this number remained more or less steady.

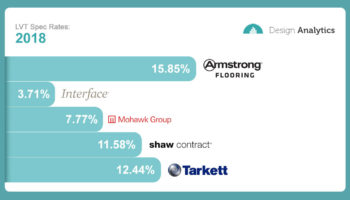

Looking at top products within each category, we find that Armstrong Flooring Commercial’s Natural Creations with Diamond 10 Technology has been the top performer in LVT, with one-, two-, and three-year specification shares of 5.2%, 5.5%, and 5.2%.

Over the same three-year period, the top product for Carpet was On Line by Interface with specification shares of 1.0%, 1.6%, and 1.6%.

What can we infer from the above? For one, LVT’s gain on carpet seems to have leveled off. For another, the LVT category remains less diffuse than that of carpet, given that the top-specified product in the latter category comprises a specification share that’s 3.6% less than the top product in LVT. While this is likely a consequence of carpet being an “older” category and thus populated by a greater number of competitive products, it may also signal an opportunity for manufacturers of LVT to gain on Natural Creations.

As the advancements realized by Armstrong become standardized across the category, other LVT products may start to erode their market share. But perhaps Armstrong has anticipated this. Julie Eno, Director of Channel Marketing for Armstrong, says that they’re already transitioning from the 3.2 mm Natural Creations line to a new collection of 2.5 mm LVT: “We still have a Natural Creations collection, but we’re very excited about the new designs.”

Armstrong’s latest LVT collection is comprised of six vibrant new patterns. Featuring an ultra-realistic printed layer and a low-gloss finish, they offer an enhanced design palette of geometric forms and wood patterns, earthy neutrals and dynamic pops of color. The new LVT line also ups the sustainability quotient: All six designs are third-party verified and FloorScore-certified for low greenhouse gas emissions; they contain 29% recycled content; and they’re end-use recyclable via Armstrong’s On&On Program.

All of this is to say that Armstrong is setting the bar quite high in this category. Design Analytics** will be curious to see how other manufacturers respond—and if LVT resumes the pattern of gaining on carpet during 2022. We’ll report back soon with another look at analytics trends in architecture and design.

*Data courtesy of Design Analytics.

**For information on customized analytics solutions, contact Mark Daniel, VP of Design Analytics: mark.daniel@analytics.design, 254 488 2350.

Leave a Reply