Armstrong Flooring Narrows Product Focus While Others Broaden

As reported recently in Floor Covering News, Armstrong Flooring has reached an agreement with an affiliate of American Industrial Partners (“AIP”) to sell its wood-flooring division for $100 million, a lucrative deal that’s “valued at approximately 7.2 times the Wood Flooring segment’s trailing twelve month Adjusted EBITDA.” The sale appears to be central to a larger strategy of focusing on resilient vinyl flooring—an approach that conforms to Design Analytics data, which shows that the fastest growing category of the flooring industry is Luxury Vinyl Tile (LVT).

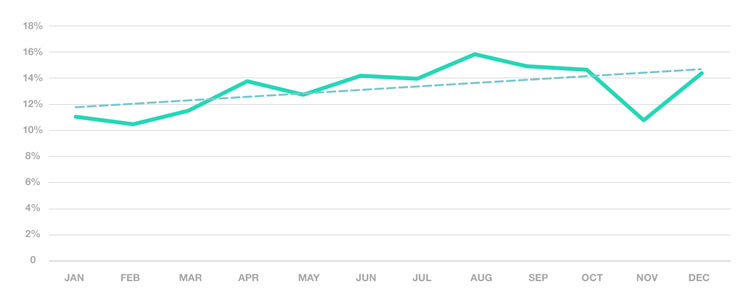

% LVT / Flooring Time Series, 2018

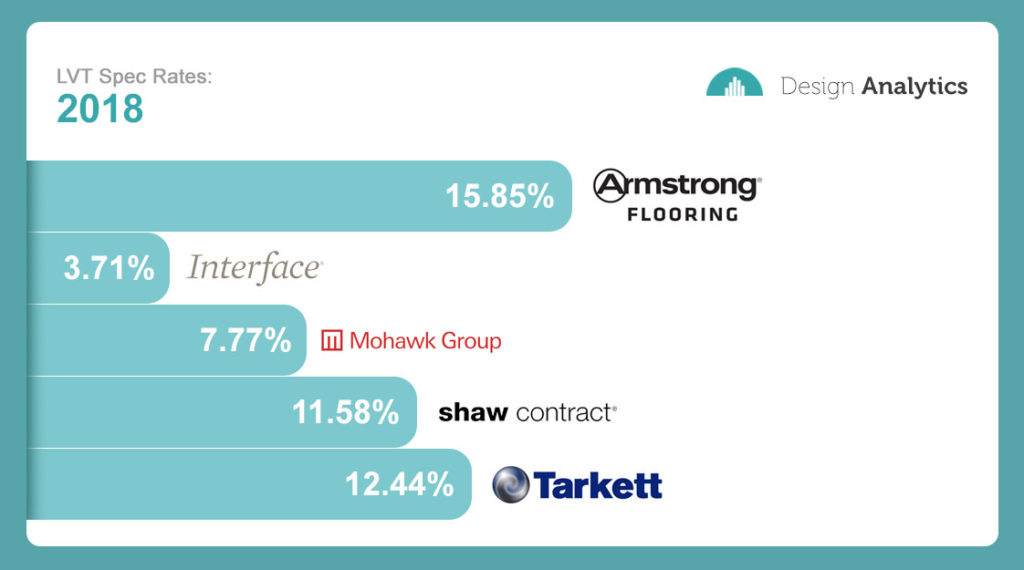

Looking at data from the last year, we see that Armstrong Flooring has performed superbly in LVT, leading all manufacturers with a specification rate of 15.85% (for the one-year period ending 12/31/18), which is 1.27 times the spec rate of the next closest competitor, Tarkett North America (at 12.44% of LVT specs), who manufactures LVT under the Tarkett brand, but also under the Johnsonite Flooring and Tandus Centiva brands. Next is Shaw Contract at 11.58%. Other major flooring manufacturers performing well in this category include Mohawk Group and Interface at 7.77% and 3.71% respectively.

Note: we have omitted other flooring brands that evince strong performance in LVT (Mannington Commercial is one example) because our focus is on flooring companies of similar size.

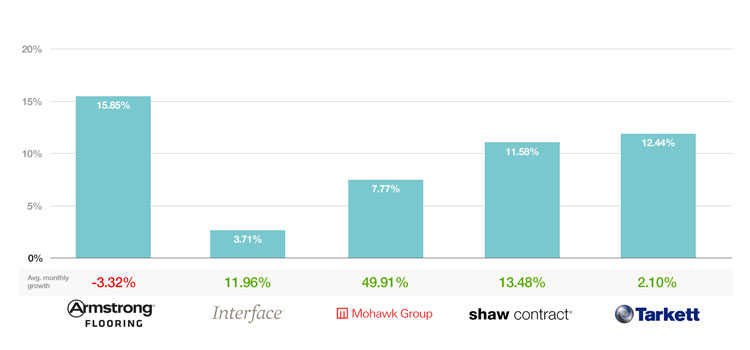

When we examine average monthly growth during the same period, we find that Armstrong Flooring’s dominant spec rate is accompanied by minimal contraction, as specs for LVT have decreased during the same time period by 3.32%. Tarkett North America shows a slight upturn (spec growth of 2.10%). Among other competitors, Mohawk Group shows the most growth (49.91%), while Shaw Contract and Interface each show significant growth as well (13.48% and 11.96% respectively).

% LVT Specifications by Brand, 2018

Given Armstrong Flooring’s high spec rate and decline in growth, as well as the robust growth of Mohawk Group and the steady growth of Shaw Contract and Interface, it’s somewhat difficult to name a clear “winner” in terms of the various strategies employed. Another factor is that Armstrong Flooring has an established history of focusing on fewer product categories, largely because they are the only company named above without a carpet line. It may be prudent to keep an eye on Mohawk Group, as their combination of impressive growth with a relatively modest spec rate could indicate that their LVT spec rate will rise during the coming year as they continue to increase their focus on LVT.

Additionally, Tarkett North America recently announced that they will be unifying all their brands (including Desso and Lexmark) under the Tarkett North America brand name—a move that will likely enhance market momentum as the Tarkett brand becomes more prominent, especially in regards to vinyl flooring. Says Andrew Bonham, President & CEO of Tarkett North America, “Going to market with a unified Tarkett branded portfolio provides clarity for our customers and delivers an enhanced experience.”

Note: Data for Tarkett North America does not include Lexmark (a brand that does manufacture LVT) because the Lexmark acquisition occurred so recently (late August of 2018).

How will the jockeying between Armstrong Flooring and Tarkett North America in this category play out? Will the former’s strategy of a narrowed product offering continue to be effective? Or does Armstrong Flooring’s negative average monthly growth for 2018 indicate that their LVT spec rate is likely to suffer a downturn? And how are the other major manufacturers responding to the growing market for LVT and associated resilient products? Can we discern an impact on their product portfolio balance?

Major Brands Augment Product Portfolios

After launching its first LVT collection just two years ago, Interface made a substantial addition to their resilient line with the August 2018 purchase of prominent rubber floor manufacturer Nora Systems. Likewise, Shaw Contract enhanced their product lineup with the additions of two major categories: the PET resilient collection is a new environmentally friendly line of resilient flooring made of 40% post-consumer PET bottles; similarly, the Engineered Hardwood line is Shaw Contract’s first foray into this product category. Tarkett North America is also expanding resilient vinyl offerings. In January 2018, they announced a proposed $60 million expansion to their two LVT production plants in Florence, Alabama. They will also be building a new distribution center in the same location. Jeff Fenwick, president of Resilient, Tarkett North America, says, “This is a strong signal of Tarkett’s commitment to long-term growth and sustainability.”

Mohawk Group, for their part, may have exhibited the most foresight in anticipating the growing market for LVT. In 2014, they built an LVT manufacturing facility in Belgium; in 2015, they acquired IVC, substantially increasing their vinyl tile manufacturing capability; and in 2016 they announced plans for a $100 million investment in their LVT manufacturing facility in Dalton, GA, adding 200 jobs. According to Brian Carson, President of Mohawk Industries’ Flooring North America segment, “This major investment to expand our U.S. LVT production will meet increased demand and enhance Mohawk’s position as the global leader in LVT, the world’s fastest growing flooring category.”

Product Adjacency Advantage

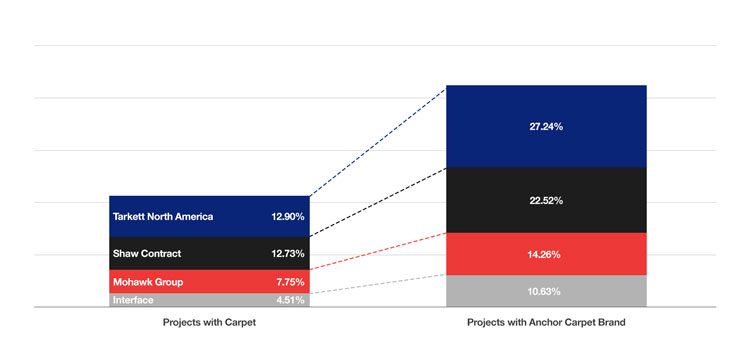

The efforts to increase LVT manufacturing capacity are only part of the story. Looking at spec behavior provided by Design Analytics, we find that LVT spec rates increase proportionately with adjacent specifications for carpet. For example, Interface’s LVT spec rate is 4.51% in projects with carpet (any carpet, irrespective of brand), but when we examine Interface specs for LVT when Interface carpet is specified as the anchor carpet brand, we find that the spec rate for Interface LVT rises to 10.63% (an increase of 236%). As illustrated below, this product adjacency bump is not only pronounced in the specifications for Interface, but also in those of Mohawk Group, Shaw Contract, and especially Tarkett North America.

Adjacency Bump: Increase in LVT Spec Rates with Anchor Carpet Brand

Given that Interface, Mohawk Group, Shaw Contract, and Tarkett North America are building their resilient flooring line (with Shaw Contract also adding engineered wood), and that Armstrong Flooring has scaled back on traditional hardwood, each of these companies appears to be observing the general trend of enhancing vinyl/resilient. Nor should Shaw Contract’s addition of engineered wood be interpreted as a dedicated growth strategy targeting engineered wood alone. To the contrary, our research indicates that Shaw Contract’s engineered wood line is an effort to make their overall flooring collection more comprehensive, opening up opportunities in adjacent categories (just as carpet does with LVT).

As mentioned earlier, perhaps the signature difference between Armstrong Flooring and the other four is that the former is alone in not offering carpet. Add this to their recent eschewal of traditional hardwood, and it seems that Armstrong Flooring is streamlining their portfolio of products compared to Interface, Mohawk Group, Shaw Contract, and Tarkett North America. Given the latest results for LVT specifications, Armstrong Flooring’s highly focused approach appears to be effective thus far. However, it’s possible that this same focused approach will negatively impact the company’s LVT spec rate in 2019 because, essentially, the divestiture of their hardwood business forgoes an adjacency bump.

In contrast to Armstrong Flooring’s strategy, Interface, Mohawk Group, Shaw Contract, and Tarkett North America have all broadened their product portfolios. Somewhat paradoxically, this approach evinces increased specifications too, as exemplified in the data for adjacent products shown above. While time will tell which of these divergent strategies will be most effective, it’s possible that both will encounter success. Armstrong Flooring seems to be the wild card in this discussion, and we can only speculate as to how their strategy may evolve. As a complement to scaling back wood, perhaps they’ll develop or acquire a carpet manufacturing capability? We look forward to examining flooring spec behavior throughout 2019 in order to provide more insight.

Leave a Reply