The Acquisition of Armstrong Flooring Creates Interesting Opportunities for Manufacturers

*Top image: Armstrong Flooring VCT in a hallway at East Baton Rouge Career and Technology Education Center. Armstrong Flooring says VCT offers “durable construction, organic looks, dense patterning – and of course, color.”

With the recent acquisition of Armstrong Flooring by AHF, we’ve seen much speculation regarding the value of the brand. While there’s a fairly broad consensus that the most valuable asset here is Armstrong’s LVT business, according to data provided by Design Analytics, the transition may impact the market not by fluctuations in the splashier LVT, but by adjustments in the more affordable, more utilitarian category of VCT. This is because the data show that Armstrong Flooring has consistently been most dominant in that category, “the gorilla in the market,” as one anonymous industry insider says.

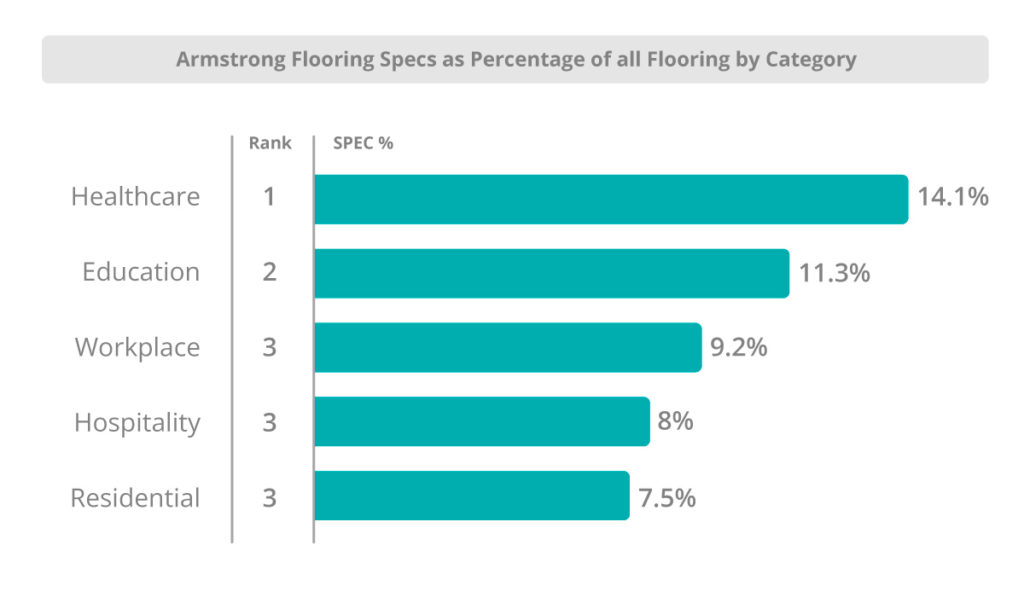

Let’s start by looking at Armstrong Flooring’s performance across all flooring categories. The chart below shows the percentage of Armstrong Flooring products specified as a percentage of all flooring for the period of August 1, 2021 through July 31, 2022, in the market segments of Education, Healthcare, Workplace, Hospitality, and Residential.

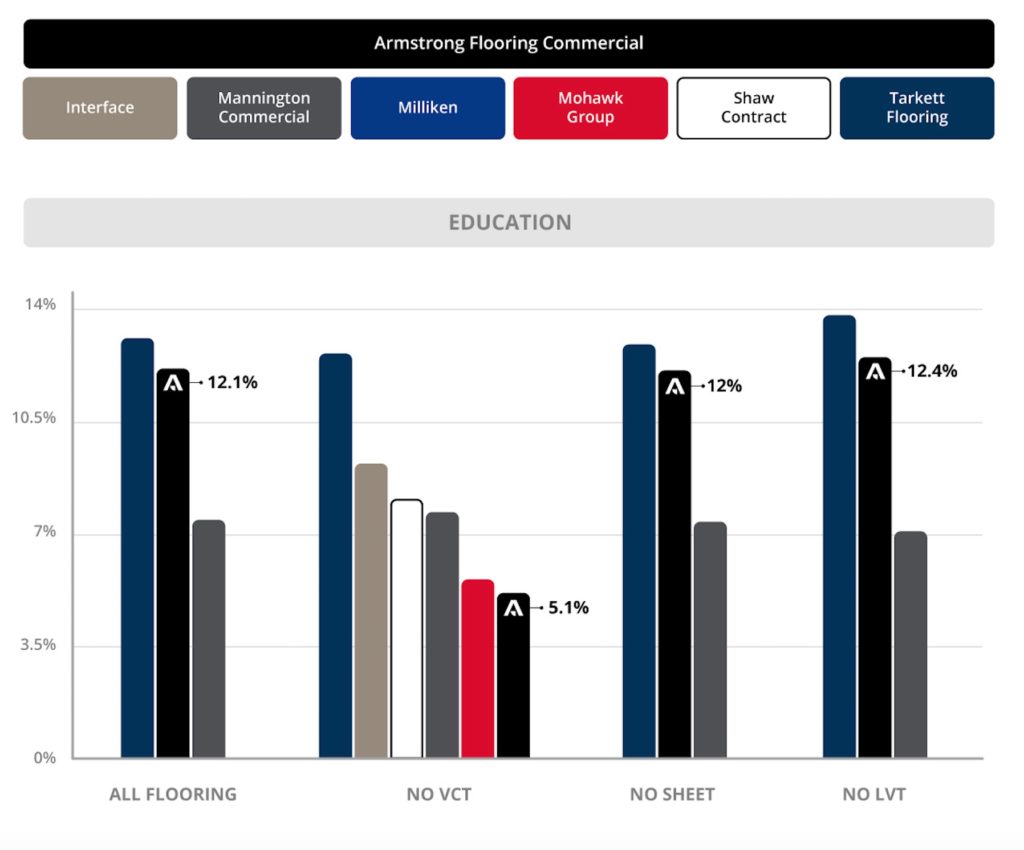

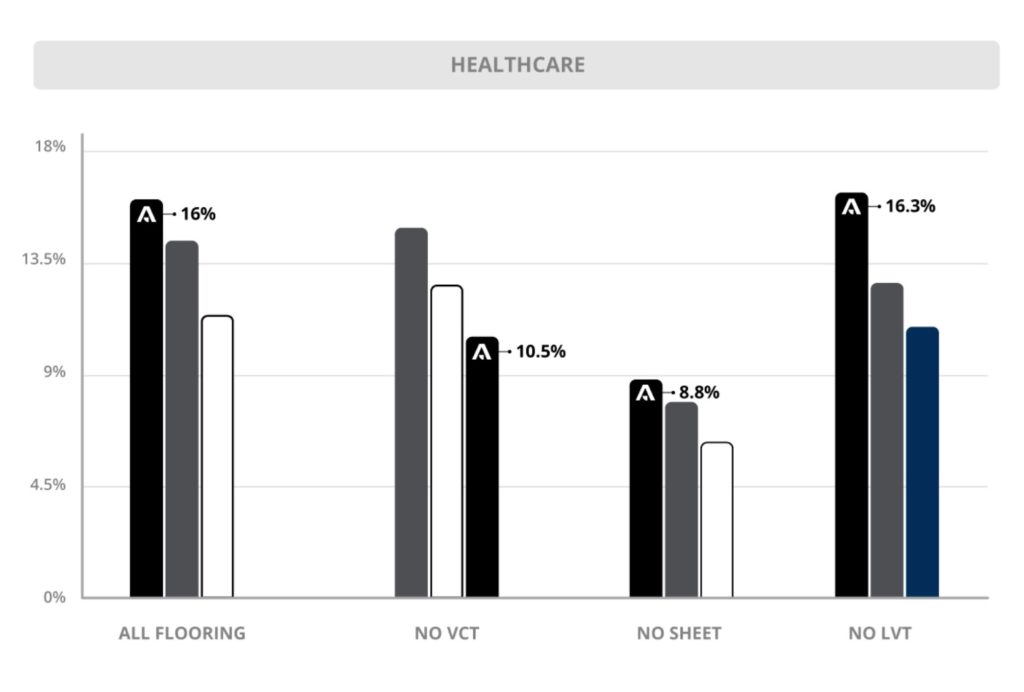

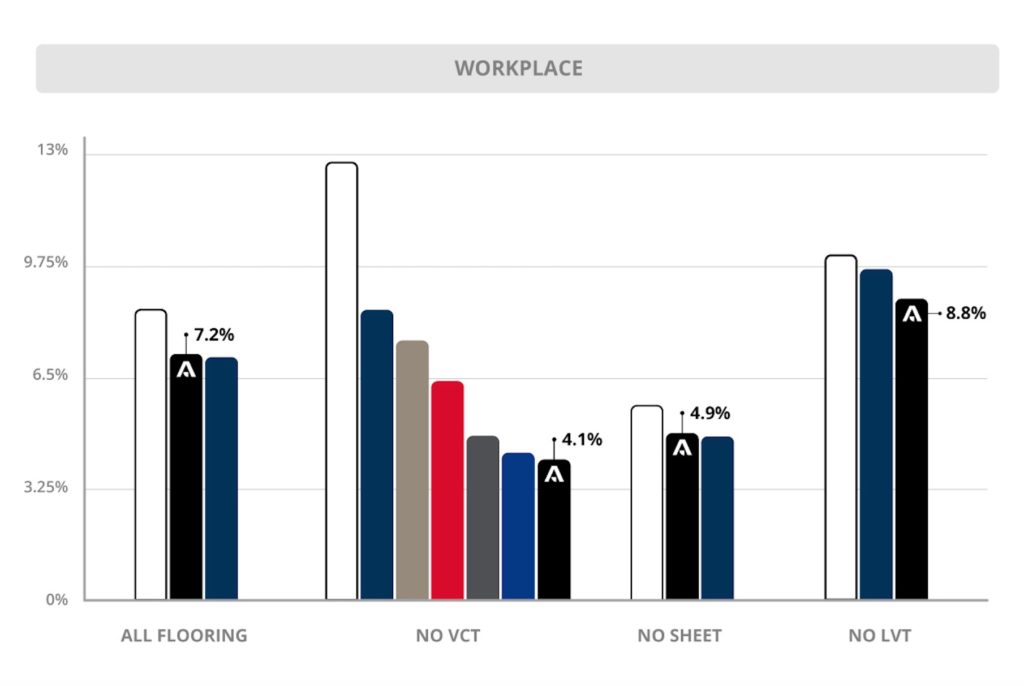

The above shows that Armstrong is most dominant in healthcare (#1 at 14%), followed by Education (#2 with 11%). They’re also ranked #2 in Workplace, Hospitality, and Residential, though their spec share falls in these categories to 9%, 8%, and 7.5% respectively. Their dominance in Healthcare and Education suggest that much of this success depends on VCT, a very commonly used product in these segments. This idea gains some credence when we remove VCT from the equation. The following shows Armstrong Flooring’s specs for all flooring compared to Armstrong specs for all flooring if we eliminate a single product. As above, the time period is 8/1/2021 – 7/31/2022.

As you can see, without VCT, Armstrong experiences a precipitous drop, falling to #3 in healthcare, #6 in education, and #7 in workplace. The same cannot be said when we remove LVT and Sheet, as Armstrong remains at #2 in Education and #1 in Healthcare when we remove specs for both products.

The above suggests—at least to some degree—that in spite of all the press around LVT and around Armstrong Flooring’s ownership of their own film company, the main move here by AFH may be to consolidate their share of the market for VCT. However, there are lots of variables at play. We can speculate that, as an AHF brand, Armstrong Flooring will continue to produce VCT, but, as one anonymous industry insider says, “Ostensibly AHF would be the dominant VCT/Sheet company now and essentially the competitive market dynamics would remain unchanged, but acquisitions aren’t seamless in the best of times and probably far less seamless when purchasing assets in bankruptcy.”

Armstrong Flooring Excelon VCT: “A Classic Economic Value”

Thus begging the question, which other manufacturers stand to gain? Is it worth anyone’s while to make a play at VCT? Jeff Trattner, Principal Consultant with 360 group and former VP of Marketing at Roppe Holding Company, stresses that VCT’s allure is somewhat diminished because of its run-of-the-mill reputation. According to Trattner, VCT isn’t a product that supports innovation and business development. While he acknowledges that it might help “keep the lights on for a bit,” he questions its overall importance in a comprehensive business development strategy:

“VCT is interesting because everyone’s been calling for its death for 10 years, yet it manages to survive. It’s got a place in education and maybe healthcare, but the question is whether or not there’s still a market for it. Right now, it’s big in retail. Stores like Home Depot, Lowe’s, and Menards will take it because it’s really cheap. It’s also good for multi-family construction and rehab, but it’s certainly not where I would invest the future of my business.”

He goes on to say that, from an acquisition’s standpoint, Armstrong Flooring’s main allure is their innovations in LVT: “I could see someone wanting to take the LVT business and that’s about it.”

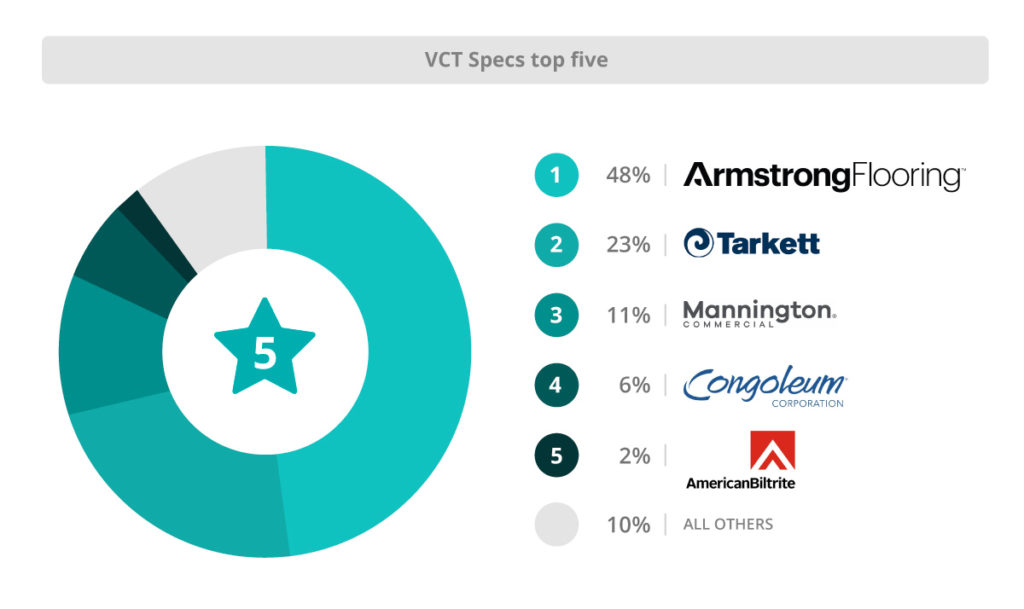

On balance, LVT has more aesthetic appeal than VCT. It also has an “on-trend” dimension right now, principally because of its increasingly realistic reproductions of natural materials like wood and stone. Even so, our data show that manufacturers would do well to consider how the acquisition may open up opportunities in VCT. Here’s a look at the top manufacturers in this product category for the year ending July 31 of 2022.

In VCT as a stand-alone product category, Armstrong Flooring dominates with 48%, followed by Tarkett at 23%, and then Mannington Commercial in the third position at 11%. If AHF Decides to reduce production or otherwise fails to meet Armstrong Flooring’s previous output of VCT, then Tarkett is in the best position to capitalize. However, some portion of the VCT market may be there for the taking for any manufacturer who wants to explore opportunities in Education. Design Analytics’ data shows that, for the period of July 2021 – June 2022, 24% of the square footage of education products was VCT, by far the largest type of flooring in this segment.

It’s pretty clear that VCT is fundamentally important for K-12 projects, so it’s reasonable to assert that any manufacturer wishing to make gains in this segment should increase production of VCT. Anecdotal data (from an anonymous sales rep formerly with Armstrong Flooring) also suggests that managers who specify VCT for education projects also tend to specify LVT from the same manufacturer in the project as well.

LVT Flooring from the AHF brand, Parterre, in a classroom at Georgia State University Alpharetta. While there’s a growing market for LVT in classrooms, particularly in Higher Ed, VCT remains the workhorse of the education segment.

The dynamic between VCT and LVT in education projects is interesting because designers would rather use LVT, yet VCT remains the biggest bang for the buck. Some sources suggest that AHF may raise their price for VCT in an effort to increase profitability, yet if prices rise too much, this may tip the balance in favor of LVT. Again, we return to the conception of VCT as a reliable workhorse—not the sexiest product, but one that gets the job done. If increasing numbers of manufacturers remain starry-eyed with the aesthetics of LVT—and especially with the allure of realistic reproductions of natural materials—then the opportunity to slip in under the radar with VCT in K-12 presents itself, especially if AHF, banking on the idea of a captive market, reduces production, or increases prices, or gambles by doing both.

We’ll be keeping an eye on flooring specs in VCT and LVT in the coming months, as well as continuing to appraise the impact of AHF’s acquisition of the Armstrong Flooring brand. Check back soon for another article examining these trends with data from Design Analytics. For information on customized analytics solutions, contact Mark Daniel, VP of Analytics, at mark.daniel@analytics.design or 254-488-2350.

Leave a Reply